Have you been thinking about investing, or you’ve started to buy some assets and now you’re not 100% how to construct a portfolio that will serve your financial goals?

I have been asked a lot lately about how to invest $20,000 in low to medium risk assets. Now it doesn’t matter if you have $20,000 to get started, a bit less or a lot more, the principles are the same.

Constructing a portfolio is one of the things that seems to stop people in their tracks, and I get that, it’s an important part of your success in the long term.

Keep in mind, despite what you may have heard elsewhere, there is NO right or wrong answer when it comes to how to construct a portfolio.

So let’s take a look at some tips you can use to get started and to use over the course of your financial journey…

What Assets to Include in Your Portfolio

One of the things that is frustrating about the financial markets is the large number of different assets that are available to invest in….

The key to keep in mind however, is that in the end it generally comes down to just three main asset classes. The rest are just fancy variations, and sometimes they are just complex to help make it easier for so called experts to sell them to unsuspecting investors.

Don’t be fooled however, the main asset classes are all you need to know about.

So what are they?

Simple, it’s stocks, property and what I call cash-based investments such as gold, silver, term deposits and bonds.

Yep, that’s all you need to know about when it comes to how to construct a portfolio for long term success.

You are going to want a mix of each over the long term. I’ll come back to this shortly.

The Impact of the Economic Clock

You may have heard about the economic clock, but just in case you haven’t, here is a quick snapshot.

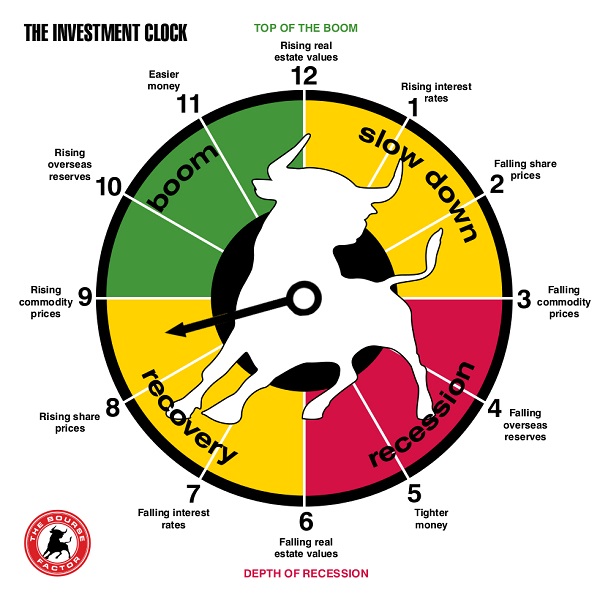

The economic clock is a representation of how world economies are performing at the time and what assets are growing in value as a result of economic growth.

So when economies are charging along, normally as a result of companies generating profits and growing employment, it normally means the stock market is also growing.

It’s not an exact science, which has been quite noticeable in recent years, but it is a good guide when you are getting started.

To give it some context, world economies are moving into or already in recession, which tends to suggest cash-based investments will outperform during this time. So there’s your first hint for what you can be accumulating right now.

The Impact of Your Starting Balance on How to Construct a Portfolio

This might seem obvious, but how much money you are starting with will have an impact on what assets you choose when starting or growing your portfolio.

Property for instance generally requires a reasonably large sum of money to make a direct purchase. But that doesn’t mean it is out of reach when you start. More on that shortly too.

On the other hand, getting started in stocks is now even easier. if you are buying stocks directly you will need $500 for a minimum parcel size. This may differ in your market so check with the exchange before investing.

There are also now a growing number of companies that offer micro investments to help people with small balances enter the stock market. Again check your local market for options on these micro investments as they are growing in number quite rapidly.

The idea of these micro platforms is that you can invest from as little as $2, although I don’t recommend you do that due to the high fees percentage, but it does at least give you options.

When it comes to cash-based investments, there will be restrictions on what you can do if you are making direct investments, particularly in things like physical gold and silver or bonds, but again there are choices.

Some Alternative Options

As I alluded to above, where your options are restricted for direct investments, like say with property, there are some very good alternatives to enable you to get started in property.

The alternative option is what is called Exchange Traded Funds or ETFs.

There are ETFs for all the asset classes I have mentioned in this post, which means you can participate and grow your portfolio from the beginning across all the asset classes. That’s great, right?

One of the things that concern new investors is risk, and that is great that you think about risk, so having the option to diversify your investments from the beginning is a good way to manage your risk.

Which leads us to the important, million-dollar question, how to allocate your funds?

How to Allocate Your Funds to Build Your Portfolio

This is another place where you will read all types of fancy strategies for what percentage you should in each asset class…

And the simple truth is that there is NO right answer!

When you are starting out, your available funds are going to dictate what you do. For example, if you have $5,000 or less to invest, it is highly likely that you will look at ETFs to start.

You can buy a spread of different ETFs that gives you exposure to each of the asset classes, or you can refer to the economic clock and weight your investments higher to the asset class that will outperform in the short term.

You then add the other asset classes as the economic clock moves through the time zones.

On the other hand, if you have $20,000 or more to get started, you could choose to invest directly into specific stocks, ETFs for property and a mix for cash-based investments.

The key to keep in mind with cash-based investments is that there are times when they don’t provide much in the form of growth or income returns, so it is normal to have a smaller percentage of your total portfolio in this asset class.

Conclusion

When it comes to how to construct a portfolio whether you are just starting out or you have $20,000, and you want low to medium risk, the recommendation is to spread your risk across the three asset classes outlined in this post.

Once you get started and are looking to grow your portfolio, keep an eye on the economic clock, which you will be able to read about online, and that will give you an idea of where to add to your portfolio at the time.

The most important thing to your portfolio is balance and an allocation across all the asset classes mentioned.

If you want to learn more about how to construct a portfolio and access my selection criteria, then you should join Investing Bootcamp, click here for all the details.