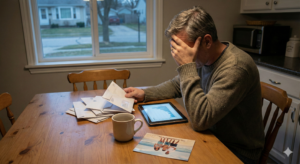

Money regret is that sneaky feeling that creeps in when you hit your 40s and realise… you’re not as far ahead as you thought you’d be.

If you’re in your 40s and feeling it, you’re not alone. This is the decade where everything gets real. The kids cost more. Work is busier. Retirement is no longer this thing for “old people”… it’s starting to look a bit closer than you’d like.

And yet, with all the hard work, most people still feel like they’re guessing.

And if you’re not yet in your 40s, this could be the wake up call that hits the mark.

That’s where the money regret creeps in. It’s not loud. It’s not dramatic. But it’s there. Sitting in the background when you check your super. Whispering when someone else seems ahead of you. Gnawing at you when you hear the word “retirement” and instantly want to change the subject.

Why money regret sneaks in during your 40s

This is the age where you start comparing. Not just to others, but to the version of yourself you thought you’d be by now. You imagined things would be more sorted. More secure. Less guesswork, more confidence.

Instead, you’re juggling mortgage stress, kids’ sport, school fees, groceries that feel like a joke, and maybe the same car you swore you’d upgrade five years ago.

You’re not lazy. You’re not behind. You’ve just been stuck in survival mode, doing the best you can. And for a while, that works. But eventually, you look up and think, “Is this it?”

The real cost of money regret isn’t dollars

Here’s the truth no one wants to say out loud. The worst part about money regret isn’t the lost dollars. It’s the time.

Time you didn’t invest.

Time you didn’t plan.

Time you can’t get back.

But let me stop you there. This isn’t a guilt trip. You did what you knew. You’ve been busy living, providing, supporting. You haven’t failed. But now you’ve got a choice. Let the money regret keep you stuck. Or use it as the spark to change the game.

Like Matt, a client who has told me that he wished he met me years ago, yet in the last two years he has grown his wealth by more than six figures. While he can’t get the time back, at least he has been doing something with what he has now. The change to his current and future wealth is life changing.

So don’t let time be the excuse, take action and use what you do have, not fret about what has passed.

How to flip money regret into momentum

You don’t need to tear everything down. You just need a plan that actually works in real life.

Start by getting clear on where you are right now. Not where you wish you were. Not where your mate at work says you should be. Just where you are. This is your starting line.

Then make your money do more than pay bills. Make it work for future you. Give every dollar a job. Set up a system where money flows toward your goals, not just toward groceries.

Wealth isn’t built with one big moment. It’s built with hundreds of small decisions. The sooner you give those decisions direction, the faster your money starts working for you, not against you.

Your story isn’t finished yet

If you’re reading this in your 40s, here’s what I want you to know. It’s not too late. Not even close.

You can still build wealth. You can still retire on your terms. You can still give your family more freedom than you had.

But it won’t happen by accident. And it won’t happen while you’re still pretending everything will somehow sort itself out.

This is your turning point.

Money regret doesn’t have to follow you into your 50s or 60s. It can end right here. Right now. With one choice. To stop drifting. To stop guessing. To stop waiting.

And to finally take control.

You’ve still got time. Let’s make it count. In the end it’s not the money that you want, it’s the time and choices that it provides. Let that be the motivation. What could you be doing, who will you share your time and money with, and what will that mean to you and your loved ones. That’s all the motivation you need.

Book your free Smart Investor Call and let’s start growing your wealth—one smart step at a time.