Your future wealth is something that is no doubt very important to you. No brainer, right?

This week I have been contemplating one of the risks to your future wealth…

Especially for those that are just starting out and are fearful of what to do in the current economic climate.

One of the things that cause people not to get involved in creating wealth for themselves is a fear that markets will collapse just after they enter and they watch their hard-earned money rapidly decline in value.

As stock markets are climbing to and above all-time highs it is a good chance to contemplate what you should be doing right now about your future wealth.

Are Stock Markets Going to Collapse?

If you look at stock markets around the world you will note that the US and major European markets are at or near all-time highs, and so is Australia finally.

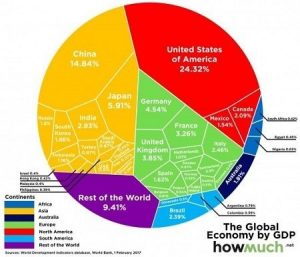

The diagram below (Source: Visual Capitalist) shows the size of the global economy by country by gross domestic product.

The key point to note from this diagram is the size of the major markets such as the USA, China, and Europe.

The reason I point this out is that what happens in these markets will filter to the rest of the world, whether we like it or not.

Now you might be thinking that with the US and Europe at all-time high levels that everything is great and investing in stock markets is a safe option.

But here is the risk…

Warren Buffett has a great quote to explain this point:

‘Be fearful when others are greedy and greedy when others are fearful’

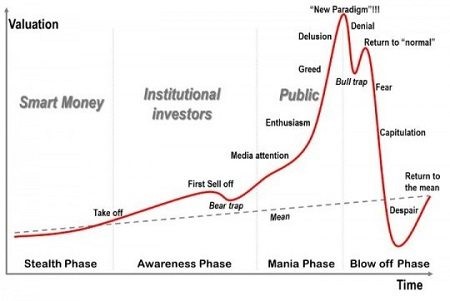

This diagram from Hofstra University, New York shows the phases of a stock market.

It is reasonably safe to suggest that world markets are in the mania phase per the diagram. There are many reasons why this is the case that is beyond the scope of this post, however, it is worth noting that there are significant pressures on company earnings that are counterintuitive to stock markets continuing to increase.

So does this mean that markets are going to collapse?

Well I’m not a stock market predictor, and nor should you be, but it is fair to say that stock markets are at high-level values today and therefore the risk of a fall is also high.

That isn’t to say that they can’t go higher, it’s just a riskier investment.

To protect your future wealth, there may be less risky options for you.

What about Property Markets?

Property markets are a lot more difficult to generalise…

There are pockets of growth available in all markets all the time. In Australia, there is talk of a bubble in the property market. When the mass media are talking about a bubble and how it can’t continue, normally the opposite happens. The caveat is if the Government intervenes, which is unlikely right now.

Property markets always remind me of the saying about the best time to plant a tree, 50 years ago or today…

Success in property is about finding the right type of property, in the right location, with the right attributes for growth and income.

Success in property is about finding the right type of property, in the right location, with the right attributes for growth and income.

Again, the determinants of these factors are for another post. The key message for this post is that property is an option to consider providing you have done your research.

The good thing about property is that if you can’t do the research yourself there are options available to you to help identify properties that are investment-worthy.

Smart Money

So the question you might have is what is the smart money doing and how can I apply this knowledge to my future wealth…

When it comes to investing and building your future wealth I have always been an advocate for doing something every day, week, or month to progress toward your financial freedom goals.

In times of uncertainty or market situations that are higher in risk, there are still things you can do.

Interest rates are at historical lows, and likely to stay there for the foreseeable future. The impact of the pandemic will make sure of that, even with Governments pouring money into the economy.

The lesson for you and your future wealth is that interest rate rises are generally a reaction to inflation or Governments trying to manage the speed of their economy to protect it from major shocks…

Now is a time to be careful though. There has been a lot of stress in family budgets and world economies.

Now is a time to be careful though. There has been a lot of stress in family budgets and world economies.

The smart money will be moving into markets to take advantage of current circumstances. I recall a mentor once saying to me that the wealthy make more money in difficult times than any other time because they stay active while everyone else sits on the sidelines.

Your Future Wealth – The Alternative Options

However, if you have been, or are now, concerned about investing in either the stock or property markets, but want to make sure you are doing something to build your future wealth, I suggest considering these alternate options…

- Build your cash reserves

- Reduce your debt

Both of these options will improve your net wealth, so you are still moving forward…

While interest rates are low it is a great time to put any extra cash on your loans to get them down quickly. Reducing it as fast as possible is in fact a very smart option.

The more you can reduce your debt, the more cash you will have available to put away in your investment account that I referred to here.

The benefit of this strategy is that if and when the stock market corrects or collapses, or the property market becomes more affordable for you, there are funds available for you to take advantage of the markets.

Although you may feel like you are just a beginner in the investing world, applying these principles will in fact ensure that you are with the smart money and your future wealth will benefit dramatically.

A Word of Caution

Now the important thing to note is that I am not someone who can predict the market top or bottom, and that doesn’t matter to me and shouldn’t to you.

It isn’t about getting the timing exactly right, it is more about being in the correct phase of the market…

The Warren Buffett quote above will be a great guide. Watch what will happen when the stock markets start to fall.

There will be widespread panic, but not for you…

You will be watching with excitement, knowing that you and your smart money will be entering when the conditions indicate the market has found its bottom and is returning to a growth phase…

And with bags of money to play with, you will enter the market knowing that your future wealth is in safe hands.

Conclusion

Now those of you that have been concerned about where to start, or whether now was a good time to start, you can confidently choose how you want to apply your investment dollars for the best outcome for your future wealth.

You don’t need to predict the future, you just need to be aware of where we are now and respond to the market conditions that prevail…

And now you know your options.

Let me know your thoughts, leave me a comment below and let’s get started building your future wealth.

Get The 5 Steps to Smarter Money Management

The result of 20 years of research of what separates the wealthy from everyone else, and how you can do it too!