Peer-to-Peer (P2P) lending has gathered serious steam in recent years as a growing number of people opt for alternatives to traditional funding and investments choices. You could say it’s a little like money match making.

In 2017, KPMG reported P2P consumer lending was Australia’s second most popular alternative finance model in Australia’s US$610 million alternative finance (Alt-fi) market. Let’s take a look at some of the attractive advantages and potential risks of investing in this alternative finance (Alt-fi) category.

What is Peer-to-Peer Lending?

In the past, we’ve relied on banks and credit unions to fund personal loans, mortgages and business loans. P2P lending is disrupting this traditional process and bypassing the need for financial institutions. A P2P lender allows individuals to fund and borrow money between each other a via an online marketplace platform.

P2P platforms use algorithms to match investors (lenders) with borrowers, assessing the credit risk of the borrower and setting an appropriate interest rate. You’ll find this is the basic framework across the board but depending on the P2P platform, the matchmaking process can vary significantly.

P2P platforms use algorithms to match investors (lenders) with borrowers, assessing the credit risk of the borrower and setting an appropriate interest rate. You’ll find this is the basic framework across the board but depending on the P2P platform, the matchmaking process can vary significantly.

Some platforms also leave it completely up to the borrower and investor, opening up an entire marketplace of loan opportunities for both.

Once a match is made and both parties are agreeable to the terms, most P2P platforms set up the contracts and manage all administration.

The transfer of funds from the lender to borrower happens within the platform, as does the processing of the loan repayments with interest as per the agreed contract.

This alternative finance arrangement opens up far more options for both borrowers and investors outside traditional financial institution.

Potential Benefits of P2P Lending

Access to high returns:

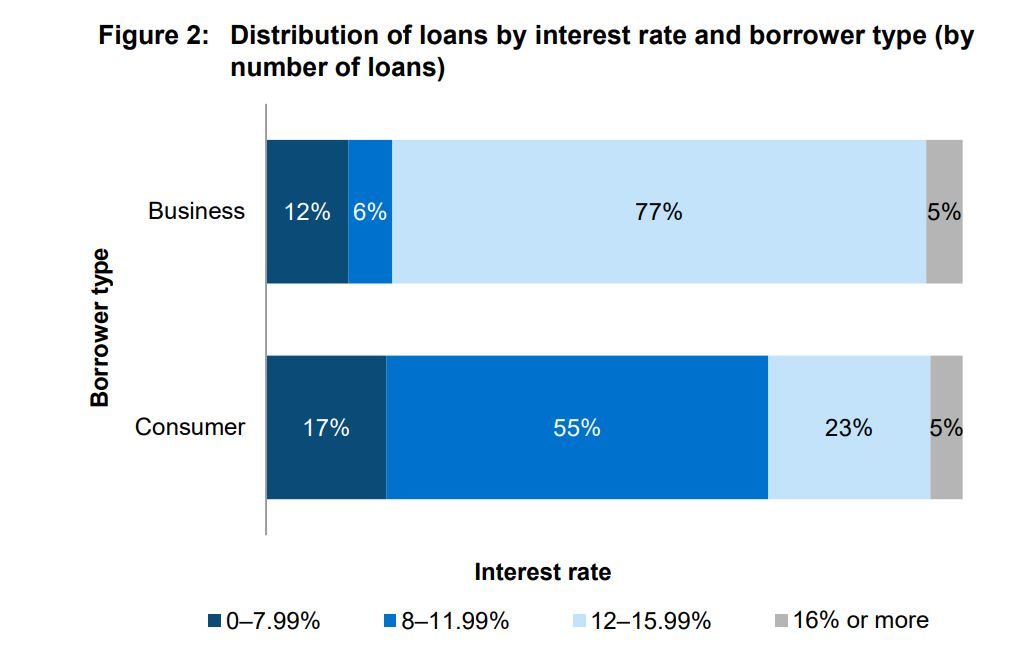

One of the biggest appeals for P2P lending is investors can potentially access returns ranging between 8% and 14% which can be higher than savings accounts, term deposits and other investments.

Source: ASIC – Survey Of Marketplace Lending Providers: 2016–17 (Dec 2017)

And if you have been following my recent discussions, with what is happening stock and property markets, cash based investing could be a great place to achieve above average returns.

Risk diversification

P2P Lending can help manage your risk exposure by spreading smaller amounts of capital across multiple loans. The more loans you are exposed to as an investor the more diversified you become which lowers the risk of your portfolio. Some P2P platforms have functionality which allows investors to easily diversify their investments across many underlying borrowers.

Access to your money if needed quickly

Some P2P platforms allow lenders to liquidate their investment in a loan if they are able to on sell the investment. The fees related to liquidating your position will vary from platform to platform so be sure to do your research first.

Receive monthly payments of principal and interest

Most three and five-year terms are locked in so investors receive some of the principal back each month along with the interest as the loan is repaid.

Potential Risks of P2P Lending

While the potential of solid returns sounds attractive, P2P Lending is not without risk.

Your investment is not protected

One of the biggest risks for P2P investors is unsecured loans. Many P2P platforms don’t offer secure lending; if the borrower defaults your investment may not be recoverable. You can reduce potential risk by opting for borrowers with the best credit scores but still, there’s no absolute guarantee the loan will be repaid in full.

Risk assessment process

To protect the identity of both borrower and investor, the P2P platform won’t share income or other documents submitted by the borrower during the authentication process to the investor. This makes it difficult to know for certain the platforms authenticity of the risk assessment.

To protect the identity of both borrower and investor, the P2P platform won’t share income or other documents submitted by the borrower during the authentication process to the investor. This makes it difficult to know for certain the platforms authenticity of the risk assessment.

Shrinking returns

If you’ve invested in a longer-term loan, say 5 years, you’ll continue to earn the same interest rate but on a smaller and smaller amount as the loan is repaid. You’ll need to re-invest the repayments or they won’t be earning you any more interest.

Interest rate rises

While the local reserve interest rate doesn’t directly affect P2P lending, it’s actions can influence how the P2P platform sets interest rates to attract both investors and borrowers. If you’re locked into a fixed term loan, there’s a risk that interest rates may rise. You won’t be able to shift your capital into a higher-bearing interest loan until your current one matures.

Due Diligence Considerations

If P2P Lending sounds like something you might like to sink your investing teeth into, there are a few important due diligence steps you’ll need to check off first. Not all P2P platforms operate in the same way so it’s crucial to understand the different options available.

>> Spend time researching the P2P lending platforms available. Canstar’s 2018 rating of Aussie P2P platforms is a good starting point.

>> Check with your local regulatory body, in Australia it is the Australian Securities and Investments Commission (ASIC), to confirm the P2P platform you’re interested in holds the relevant financial services licence.

>> Confirm if the loans have a secured or unsecured status and if you can divvy up your investment over multiple loans to reduce risk.

>> What steps does a platform take to recover your investment if the borrower defaults?

>> What fees are involved?

You should be able to find this type of information in the platforms product disclosure statement (PDS).

It is far from risk free, but P2P Lending can play a part in a portfolio. How would you feel about adding it to your investment options? Excited to give it a go or a little too risky for your taste?