It won’t bring you quick riches, but smart portfolio diversification is key to steadily building wealth over time.

However, diversification is an often misunderstood concept, one that most financial advisors manage by recommending you just by more different stocks. Trust me, that ain’t the answer or the way to manage it.

If you own a business, you will know the importance of not relying on one product, one service, one offer. Just doesn’t make for a sustainable business, right.

It’s the same with your wealth and money, you don’t want to put all your money in one asset class, one stock, one property, one timeframe.

Let’s take a look at how diversification works and why it’s important.

What is diversification?

Diversification does have complex iterations, but the basic concept is to spread your portfolio investments across different asset classes.

The idea is the investments that perform well in a diversified portfolio will balance or outweigh the other investments that perform poorly.

In a nutshell, diversification means not putting all your eggs in one basket. It’s how the wealthy manage risk to acceptable levels, and allows you to decide how much risk you are prepared to have in your portfolio. That’s a cool thing, right? Being the one in control of the risk, that’s empowerment right there.

What is an asset class?

If you’re new to the investing game, you might be wondering what an asset class is?

An asset class (or asset category) is a group of similar types of investments. These investments share similar characteristics, may react in a similar way to market influences, and, are usually subject to the same rules and regulations.

An asset class (or asset category) is a group of similar types of investments. These investments share similar characteristics, may react in a similar way to market influences, and, are usually subject to the same rules and regulations.

There are 4 large general asset classes:

- Stocks (equities) – Owning a piece of a company

- Cash – The money you have in the bank

- Fixed income (debt) – Bonds and certificates of a deposit that pay a fixed rate of return in the form of interest.

- Real estate and commodities – A physical asset like property or precious metals.

These general asset classes can be broken down further into sub-classes by location, size, and industry. The extent of diversification available these days is almost endless.

The link between asset allocation and diversification

Asset allocation is used to diversify your investment portfolio and as I mentioned above, to manage your risk.

Asset allocation means choosing to distribute investments across the different asset classes mentioned above; cash, real estate, stocks, etc.

A diversified portfolio should include a mix of growth and defensive assets:

- Growth assets – Investments like shares or property that usually provide longer-term capital gains, but have a higher level of risk than defensive assets.

- Defensive assets – Investments like cash or bonds have a lower level of volatility than growth assets and generally provide a lower return over the long-term

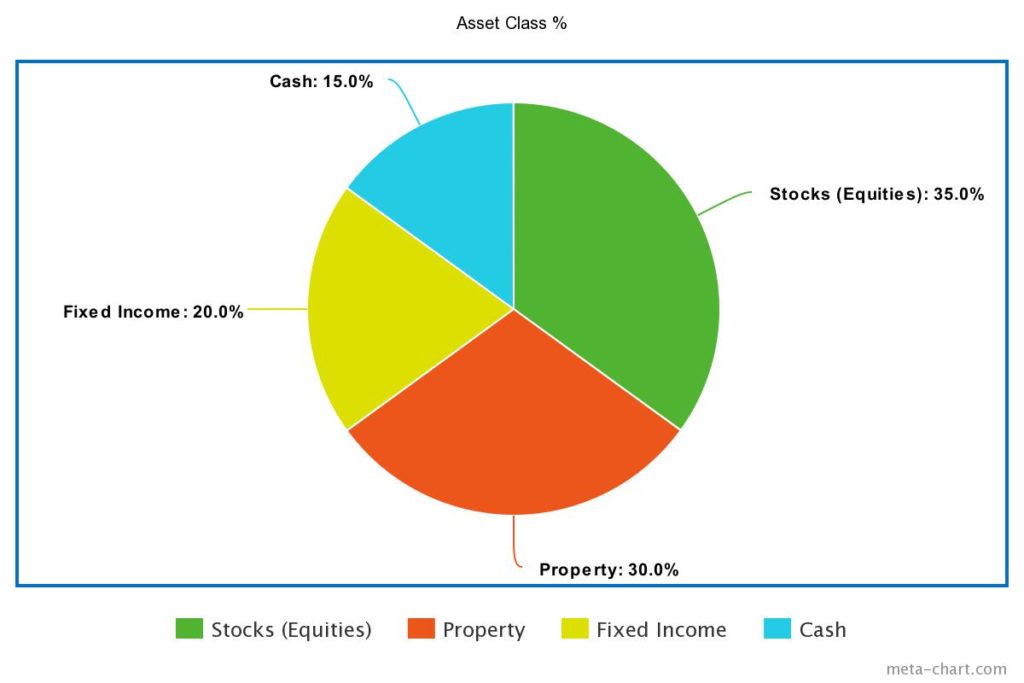

An example of a diversified portfolio may look something like this. Now, this is not what I suggest for you, everyone’s circumstances will be different, but let’s run with this as an example.

A portfolio can be diversified at two levels: between asset classes (eg, a mix of stocks, bonds, and cash) and within asset classes (eg – a mix of different types of stocks within the stock class)

How you choose the percentage mix of assets will largely depend on your ability to tolerate risk and your time horizon.

Why your time horizon matters

Knowing your time horizon – the time you have to achieve your financial goal – is critical when deciding on investments and the asset allocation mix right for you.

When you’re setting up a diversified portfolio the volatility of the marketplace poses more risk in the short term.

Say you’ve got 15+ years to meet your retirement financial goal. When the market falls during the beginning or middle stages of your time frame, it won’t pose such a risk to your investment. You’ve got a long time to recover.

However, if retirement is only 3 or 4 years away and the market takes a dive, your investment goal can be seriously impacted.

There are no hard and fast rules for the type of investments to choose for different time horizons but there are some general guidelines that can help.

5 years – Short-term goal

If you have a short-term time horizon and the market drops, your portfolio won’t have enough time to recover before you need to hit your goal. For shorter periods, your asset allocation may have more conservative assets and fewer riskier ones to focus on preserving your capital.

10 years – Mid-term goal

If you’ve got a decade to reach your goal, you can include more volatile investments as you’ll have time to recover from a negative market fluctuation. A mix of stocks, property, and bonds are common investments for mid-term goals.

10 – 15+ years – Long-term goal

Over the long-term, investments with more volatility, like stocks offer greater potential rewards. Of course, the risk is greater but with this long-range horizon, there is enough time to recover from a loss.

You can see how an asset mix for a 20 year old just starting with a long-range goal would likely look different than the mix for someone within 3 years of retirement. Or between one person whose goal is to save for a home deposit vs some saving for retirement.

You can see how an asset mix for a 20 year old just starting with a long-range goal would likely look different than the mix for someone within 3 years of retirement. Or between one person whose goal is to save for a home deposit vs some saving for retirement.

Now you have a grasp on what diversification is and how to do it, let’s take a look at why it’s important.

Lower risks

The beauty of diversification is it lowers your overall risk. It’s a risk management strategy to protect you from major loss; if one of the investments you have completely tanks, it won’t sink your entire portfolio.

Let’s say you’ve put all your eggs in one basket and have invested everything in a single stock. If that stock loses 40% over the course of 12 months, you’ve lost 40% of your portfolio in a year!

On the other hand, if you’ve chosen to diversify and that investment only makes up 5% of your portfolio, a 40% downturn won’t hit you as hard.

Help reach your financial goals

Diversification will have a major impact on whether you reach your financial goals or not.

Without diversification, you may not have enough risk in your portfolio to earn the returns you need to meet your goal.

Or, like the example above, your portfolio may be too volatile and not include safer investment options – like cash or bonds. This could also put your financial goal at risk.

Conclusion: A better risk and reward balance

Diversification is an effective way to balance risk and reward in your portfolio. You can make changes to balance your portfolio gradually by adjusting different positions. This is a safer option than overhauling your entire portfolio in one hit and exposing yourself to greater market risk.

With good financial guidance and a healthy dose of patience, diversification isn’t that difficult to do. The benefits will pay off big time in the long run.

Let me know how you manage diversification in your investing, leave a comment below.

To claim your free Wealth Acceleration call, click here to get all the details and schedule a time, and let’s chat about creating a plan to add 7 figures to your net worth.