The past month or so reminds me a lot of the scene in the movie Jerry Maguire. When Tom Cruise is on the phone competing to get his first client in his new venture and everything seems to be crumbling around him, the fear and panic in his face are palpable.

The same fear and panic seem to have hit stock markets around the world, and Australia has not been immune…

Our market has been a seesaw of emotions with some of the heaviest daily points falls seen in our history. The past week seems to have settled a little, however, the volatility isn’t over yet.

And yet despite that, I firmly believe now is not the time to panic, in fact, it could just be the complete opposite.

It reminds me of one of my favourite Warren Buffett quotes:

“Be fearful when others are being greedy, and greedy when others are being fearful”.

Let’s take a look at why this is not the time for fear or panic and could just be the time where you make some extremely fruitful investing decisions.

Historical Financial Market Performance

Right now, we are in the midst of hysteria due to that virus, which is now the next pandemic, in what is surprisingly a long list in recent times…

And don’t even get me started on the whole toilet paper thing.

World financial markets have not been immune to the hysteria. With fears of China being shut down for extended periods, markets have hit the sell button faster than you can turn the lights off. While this may not seem as though it is the ideal time to invest, it may actually the perfect time to look to send money to China. The economy there will recover and it is always best to strike while prices are low and reap the rewards as the economy starts to come around.

It makes for great television news, but is it really what’s going on, and what does it mean for the future of the financial markets?

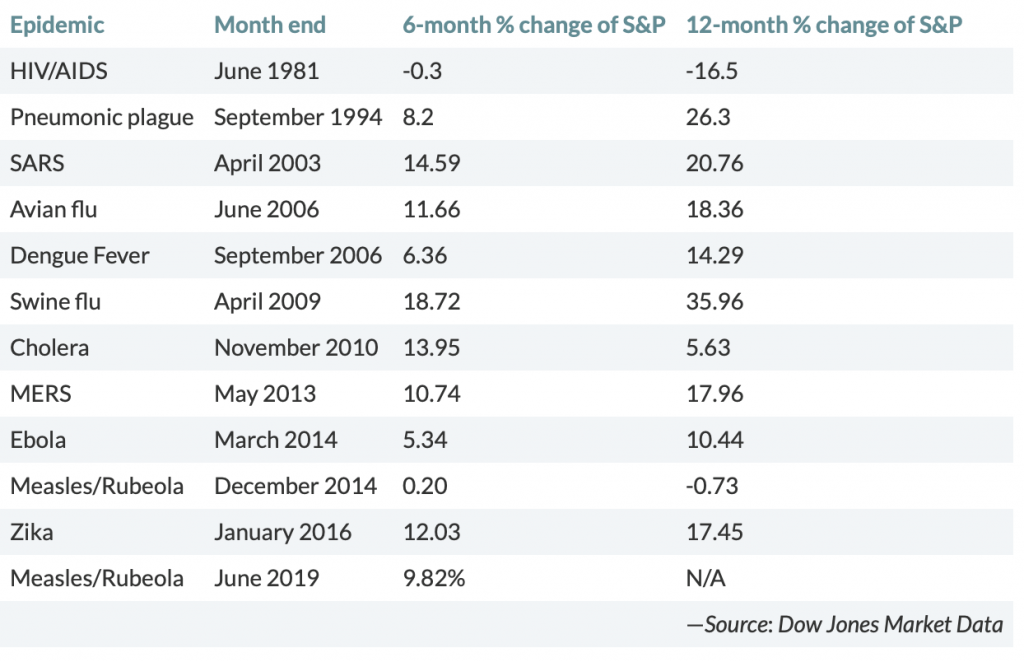

I saw this graph showing financial market performance in the six months and twelve months after several major epidemics. The first thing that struck me about this list, was how many there have been in recent times, that was scary enough.

Now, this data is for the US market, however, the Australian markets will show very similar results.

If you look at the twelve-month returns, it is quite a story. Who wouldn’t like greater than 20% returns in the next twelve months, like what was seen post-SARS and the Swine flu?

Now there is no guarantee that this will happen again, but there is a strong history of markets bouncing back strongly from these types of events… normally because the reaction is an overreaction, and markets correct themselves relatively quickly when things get out of line.

Even in the last couple of weeks, the Australian and US markets have seen bounces of 5-10% on some days. It feels for now that we are in a holding pattern, waiting to see how bad and how long this thing will last before the next wave up or down.

And remember what the great Warren Buffett says about what to do when people are fearful!

How the Wealthy Invest in Times of Fear

What has always struck me when learning what the wealthy do to succeed, is how often they have had their best results when everyone else is losing money.

Stock markets are always ahead of the news, they have the capacity to tell you what is coming, long before the 6 o’clock news runs the panic headlines about the massive falls that occurred that day.

You wake up one morning and hear that the US market tanked overnight. At this stage, it is already too late for you and me. The Australian market will open much lower in response to what has happened in the US and the fear will quickly gain momentum.

Once the fear has kicked in, mum and dad investors get caught up with losing money and feel compelled to sell. The market moves so fast the losses or loss of profits get bigger and bigger. The fear grows and more people sell. It’s a vicious circle.

On the other hand, the wealthy sit back and wait for the dust to settle and then they jump in and get greedy.

To the wealthy, it’s like the Boxing Day sales in the stock market. They know what the table above demonstrates, and they are buying up big.

As long-term investors, they know that over time the stock market will recover and achieve new all-time highs. They take advantage of the fear and the cheaper prices and go all in.

This is why, in times of fear and panic, the wealthy are renowned for making decisions that lead to some of their biggest gains.

And you can too. Just don’t get caught up in the herd mentality that breeds fear, just like the toilet paper thing.

Fear and Panic – What Should You Do?

Like I have said, now is a great opportunity to make smart decisions that will give your wealth a real boost over the coming twelve months.

Let the fear wash over you as you steadily accumulate good quality stocks or index funds. Sure, there is a possibility that markets keep falling, but that’s just more opportunity to accumulate at even better prices.

The certain thing is, that stock markets will turn around over time, and this just could be the pause in the climb up that was needed to fuel the next phase of growth.

As a famous model once said, “it won’t happen overnight, but it will happen”.

To ensure you are set up for success and poised to pounce, check out the 5 Steps to Financial Freedom program. It’s the best foundation for your success, even if I do say so myself ????