Timing versus time in the market seems to be a popular discussion, or in some cases, debate. Investors can fall into two camps.

Those who try to time the market and those who spend time in the market.

While it can be tempting to try to anticipate and react to market behaviour, some of the world’s most successful investors say real wealth generation comes from playing the long game. I know, that’s the boring answer, but let’s explore why it is the case by taking a look at the difference between these two strategies.

What is timing the market?

Buy low, sell high. Repeat.

Timing the market is when investors wait for the ideal time to buy investments or shuffle investments between asset classes based on current market behaviours.

It’s also known as active management.

It’s also known as active management.

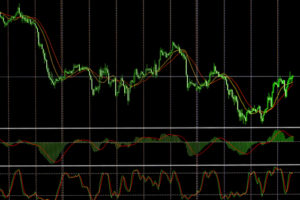

The idea is to buy when the market is low and sell when it’s high. It might sound simple on the surface but it’s a complicated strategy that calls for monitoring the market on a daily basis – or paying someone to do it for you.

And it looks real simple on a stock chart, after the fact. The problem is on any given day, you don’t know what is going to happen next. Let that sink in…

What is time in the market?

“My favorite time frame is forever.” Warren Buffett

Otherwise known as ‘buy and hold’ investing. Investors in this camp buy shares or property and hold onto them, through thick and thin, no matter how the market fluctuates.

It’s a far simpler strategy that doesn’t require you to constantly monitor the market. Just check in with your portfolio performance every now and then to see how you’re tracking against your long-term financial goals.

The debate over the two strategies will likely never die but personally, I’m for time in the market, beating out timing the market.

With one caveat, but we will get to that shortly…

Let me tell you why.

You don’t have to pick the bottom for entry

The investor who wants to time the market aims to buy investments when they have bottomed.

This is the point where its value no longer significantly falls.

Picking where this point will be and holding out for it is an intimidating play, even for seasoned investors.

While there are some common technical indicators that show a stock may have hit a bottom, it’s impossible for anyone to consistently call where this point is…

While there are some common technical indicators that show a stock may have hit a bottom, it’s impossible for anyone to consistently call where this point is…

…and picking the bottom of a property market is even harder.

Once the active investor buys at the lowest point, the goal is then to sell when it recovers and hits its highest point; which is also difficult to determine.

When you’re buying and holding, the entry point at which you buy doesn’t matter as much.

If the investment continues to bottom out, in time the market will correct itself and climb above the previous high point after a correction.

While the stock market can be volatile in the short term, with many rapid changes, over the long term it remains fairly stable. The stock market has never failed to climb above the previous high after a correction.

And look at the property market, it is fair to say you would love to have had the opportunity to buy at the prices your parents paid, right?

You don’t miss out on the good days

When you’ve committed to an investment for the long haul, you’ll be in the market on the good days when it moves dramatically.

A timing the market approach misses out on these upswings which will impact long-term returns.

In fact, there are only a small number of days that account for most of the stock market returns.

A 2009 study showed the impact of missing out on the 10 best days between 1900 – 2006 resulted in a portfolio 65% less than a buy and hold approach.

Timing the market is difficult; even for experts

Without the help of a crystal ball, trying to predict how the market will act is extremely tricky.

There are so many factors influencing the price of stocks and bonds and knowing when to get back into the market is just as important as knowing when to get out.

While expert portfolio managers practice intentional market timing, charging eye-watering fees to do so, even they find it challenging.

In 2017 S&P Dow Jones released a report that looked at the previous 3, 5, 10, and 15 years’ performance of professionally managed investments against the Dow benchmark. It found only 15% of all professional mutual fund managers were able to beat the market.

In 2017 S&P Dow Jones released a report that looked at the previous 3, 5, 10, and 15 years’ performance of professionally managed investments against the Dow benchmark. It found only 15% of all professional mutual fund managers were able to beat the market.

If the experts struggle, the odds are very much stacked against the common investor.

In fact, it is exactly why I created my Investing Bootcamp course. This course shows you how to select stocks and property by moving the odds in your favour. Check out the link below to see how you can get access to the course (it’s not for sale anymore, but you can get access if you are keen) 🙂

You won’t get caught up in the hype

Jumping in and out of different investments over short periods of time is risky. It can seriously impact long-term results. It’s easy to get caught up in the hype or panic as investments fluctuate, and make decisions based on emotion.

Patience and simplicity are the most valuable investing virtues for the long run. Consistently adding to your portfolio over time leads to growth, compounding returns, and allows you to ride out market corrections.

When you’ve committed to the buy and hold mentality, you’re far less likely to be swayed into making a rash financial decision based on emotion.

Oh and the caveat I mentioned earlier… If your investment suffers a significant loss due to unforeseen circumstances, then you can and should review the investment. If you decide that it is a bad investment, you should exit and move your money into something else. I show you how to do that in Investing Bootcamp too!!

Conclusion

The thing about time in the market versus timing the market is that you don’t have to be a professional trader or real estate guru.

Having some simple rules and guidelines to follow will reduce your risk. It will also enhance your ability to select assets that will generate above-average returns over the long term…

And that’s the thing, above-average returns over a long period of time will generate financial freedom. That’s my goal for you, so hop to it, get your money in the market.

What camp are you in; timing the market or time in the market? Let me know in the comments below.

To claim your Smart Investor Brainstorming Call, click this link, and on the call, I will tell you how you can get access to Investing Bootcamp

Thanks for enlightening the informatory stuff. All the points are described incredibly.

Overwhelmed although long term is going to be more satisfactory.

Time in the market makes most sense to me.