Financial success is inevitable (yes, inevitable) when you fully commit to two things: learning and taking relentless action.

You don’t need to hand your financial life over to someone else to be a success. Be the financial boss of your money, make the most of every educational resource available and take action. Do this and a great outcome isn’t just likely, it’s inevitable.

Let’s bust one of the biggest myths in personal finance…

I need a financial advisor or a financial degree to be great at managing money and achieve financial success

One of the biggest myths in personal finance (specifically investing) is that without a financial advisor or a formal finance education you won’t be successful.

This isn’t true.

Learn the skills you need to manage your own money and investments and the chances are you’ll do just as well, if not better, than working with a financial advisor.

The fees financial advisors charge can take a hefty chunk of your hard earned cash and there is absolutely no guarantee their advice for your money will ‘beat the market’….in fact, research shows quite the contrary.

In fact, in his most recent book, Tony Robbins dedicates almost the entire first half of the book to explaining the full cost to you and your financial future of financial advisors.

You also don’t need to pay thousands and thousands of dollars for a formal financial degree.

There are tools available to teach yourself everything you need to know about building wealth and financial success. You can literally start right now. Committing a few hours each week to learn about money can totally transform your family’s financial future.

Financial Success: Teach yourself about money

Books

Through books, you can learn from some of the best financial minds IN THE WORLD. The direction of my life and my finances were changed by a single book.

That book was Harv Eker’s Secrets of The Millionaire Mind. I regularly referred back to this game-changing book and the lessons that I took from it. I would say it is the one thing that has changed my outlook the most, and my results!

If you have been around The Investor’s Way blog or Facebook page for a while you will know I’m also a huge fan of Warren Buffett’s investment philosophies and his books. A couple I’ll mention in particular; Warren Buffett Speaks and The Warren Buffett Way.

Podcasts, blogs, and articles

This little thing called the internet has given us unprecedented access to advice from money gurus.

It’s about finding the right source that works for you and personally, I wouldn’t advise paying too much attention to the mainstream financial news updates. A lot of drama and scaremongering goes on to create big headlines.

Instead, check out podcasts or blogs and find a writer or podcaster who delivers content in a way that suits your learning style. Podcasts are great to listen to on the go – put that daily commute time to good use!

On a personal note, I want to make sure the content I create for The Investors Way is truly valuable for you. If there’s a particular topic you’d like to read about, leave me a comment below or get in touch here.

My vision with The Investor’s Way is to help 1,000,000 people take control of their money and secure their financial success. Keep an eye out for the next class of Investing Bootcamp, where I teach all you need to know to invest for a secure financial future.

Financial Success is inevitable with inspired action

“Persistence guarantees that results are inevitable” Paramahansa Yogananda

Your results follow your action. It is impossible NOT to improve your finances and your life if you consistently take inspired action.

This goes for inaction too. Do nothing and the result is nothing changes. It’s impossible to improve your situation by not taking any action.

I don’t know exactly where you are in your financial life at the moment but here are a few ideas to get started taking action today.

Know Your Why

Ok I get it, you’ve heard this a lot lately. I know it is everywhere on the interwebs, but the truth is, it is really important.

When it comes to the discipline required to achieve financial success, knowing WHY you are doing it is crucial. It’s what will keep you going when it stops being fun or when it is hard, and yes at times it will be hard.

My WHY has always been easy for me… it is simply my family, my wife and kids. Everything I do is about securing them a financial future that is full of choices and resources. Simple, but it is the thing that keeps me going every day.

What is your WHY going to be?

Set your money goals

Figure out what your ideal end result looks like. What are you trying to achieve with your money? A legacy for your family, financial freedom? Now, what are the steps you need to take to get there? You don’t need to get too weighed down in detail, just jot down an outline to get you started.

Work out how much consumer debt you have and begin to pay it off

Debt will suck the life right out of your financial progress. Dump it as quickly as you can. Even if you are facing a sizable debt that might seem overwhelming now, consistently doing everything you can to pay it off means reaching a zero balance is inevitable.

Start your emergency fund with an aim to have at least one month living expenses

If you’re free of consumer debt, focus on getting your emergency fund up and running. Every single dollar you save for your fund is a positive action. Doing this week in and week out will inevitably lead to a tidy amount socked away for unexpected emergencies. Keep building on that fund. The peace of mind it brings is worth it. You can thank me later for that one!

Get started with investing

Investing is the area many people can feel overwhelmed….and this puts them off even taking the first step.

Trust me when I say, getting started with investing doesn’t have to be the big, complicated thing you may have conjured up in your mind. You also don’t need much money to begin.

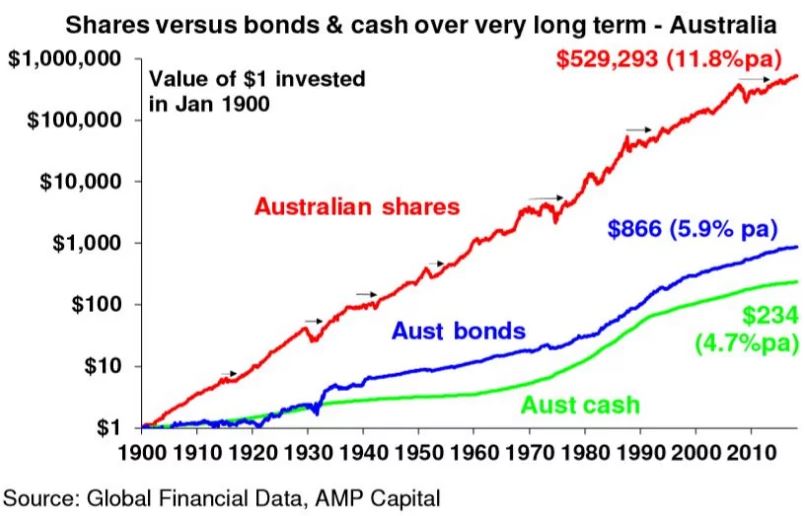

Investing is how you build real wealth and financial freedom long term. This great chart shows the inevitable increase of $1 invested in shares in 1900 by reinvesting dividends and interest.

Obviously, the chart reflects a long period of time but the point is that wealth accumulation is inevitable when we

A) get started

B) continue taking action, and

C) play the long game.

Apply lessons learned in the process

“The more information that’s out there, the greater the returns to just being willing to sit down and apply yourself. Information isn’t what’s scarce; it’s the willingness to do something with it.” – Tyler Cowen, Economist

Taking action means you begin the real educational process. We build on all we’ve learned from books and other resources by actually executing on our plan.

With action comes lessons.

Your experience along the way, including some mistakes, will teach you valuable money lessons to apply to the next step.

The key is to course correct and keep moving forward. Don’t give up. Only by actually ‘doing’ can you gain deeper insights into investing and money management.

I hope this post has been a reminder that great action leads to great results. You’ll get to where you want to go, all you need to do is get started. Let me know what you are going to do this week in the comments.