A common reason that I hear from people that haven’t started investing for their financial future is that they think they don’t have enough money to make it worthwhile.

Have you ever had that thought?

This thought often leads to the next big reason for putting your financial future off…

I’ve left it too late!

If this is what you have been thinking, you are not alone. I hear it all the time.

The good news however, is that neither of these reasons need to be the hurdles they have become for you.

I understand that not everyone can have the high paying job. You may be working really hard to ‘get by’…

You may even have only recently become responsible for your own financial affairs, and the thought of investing is scary.

But this week I want to show you what is achievable, and how you can have a comfortable financial future with as little as $40 per week.

How to Have a Comfortable Financial Future

Typically, financial gurus will talk about investing in percentages: normally the recommendation is to contribute 10% of your household income into savings or investing accounts. You’ve probably heard it too 🙂

The problem with percentages is that everyone’s 10% is different and may be big or small depending on your salary.

But what if we broke it down into a number that’s easy for you to relate to – a figure that could easily cover a dinner out or a week’s worth of cappuccinos?

When I am coaching people to take control of their money, the first thing we work on is identifying a surplus each week…

An amount of money that can be directed to your financial future before you meet all your living expenses.

Just as a short aside, notice how I said ‘before’ you meet your living expenses… that’s a writer downer right there.

So for the examples in this post, I have chosen $40 per week to show you what you can achieve.

Now if $40 seems like a stretch today, that’s fine, let’s see what can be done with this amount of money, and then we can work out ways to make $40 an achievable number for you.

At $40 per week that represents $2,080 per year, which is a lot less than 10% of the current average take home pay in most western countries.

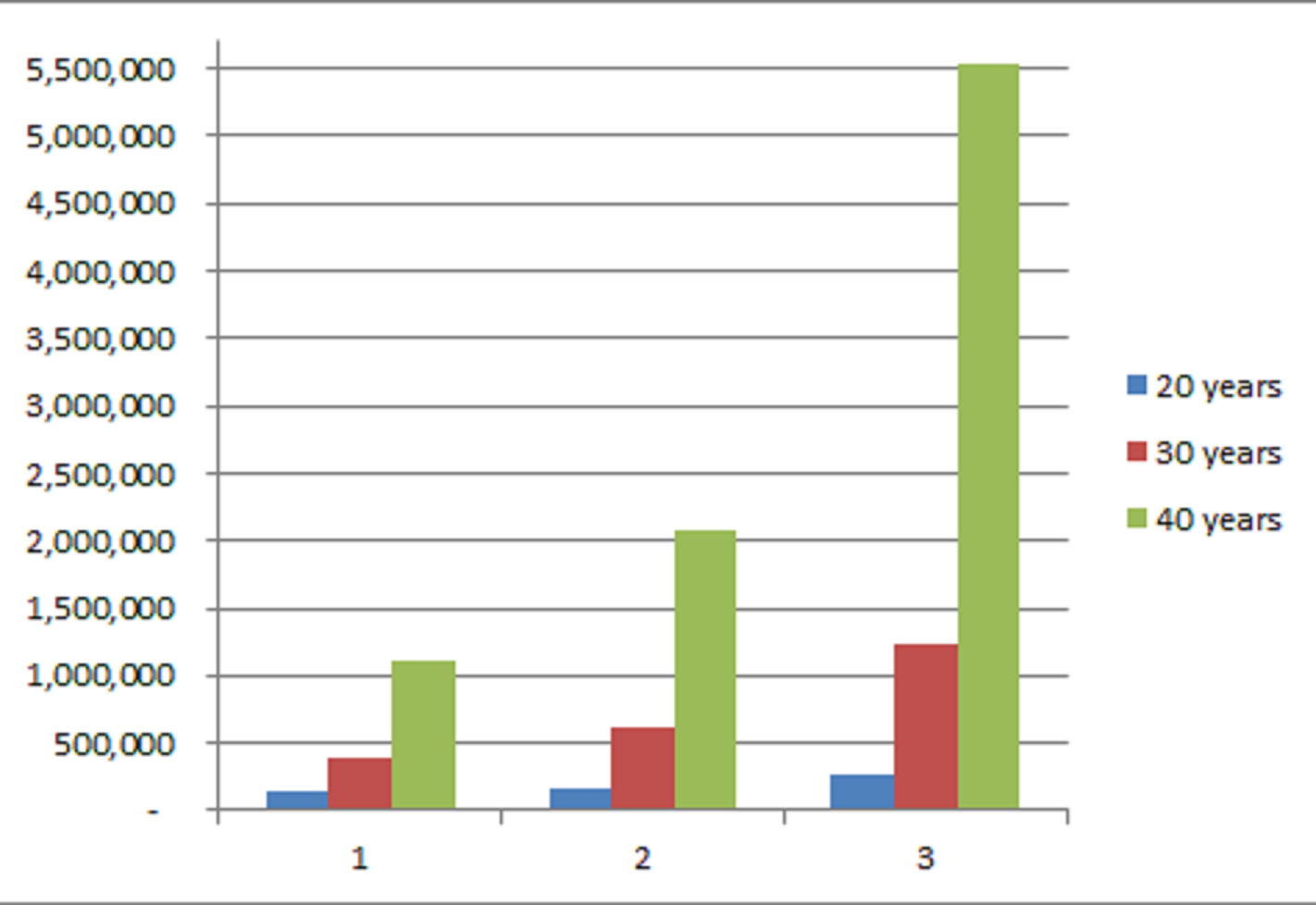

Table 1: scenario 1: 10%, Scenario 2: 12% and Scenario 3: 15%

What this table shows is a very powerful lesson about the power of time and participation.

You have heard me mention many times how investing and your financial future require action.

Your Potential Financial Future from Humble Beginnings

In the table there are three scenarios for each of three time periods.

I have used 20 years, 30 years and 40 years as the time periods…

…and I have calculated your expected future values using three different rates of return, that is, the amount you make each year.

For the sake of this exercise, and to show you how simple it can be, I have assumed you invested your $40 per week into a stock index tracking investment.

Index tracking investments are designed to mirror the returns of the overall stock index in your country or index of choice.

So if you are in the US it could be the S&P500 index, or in Australia the All Ords or S&P200.

The three returns I have chosen are 10%, 12% and 15%…

The historical average return of these index tracking investments is between 10% and 15% per annum, although higher returns are achievable.

The results in the table are a simplification of what you can achieve, but you get the idea.

For instance they don’t include such matters as your ability to increase your $40 per week, the impact of dividends, or your ability to be more active in your investing to take advantage of the good times and to manage the down times.

But, for the sake of this post, the results should have you just a little excited…

In the 40 year time period, at 10% returns you could have a tick over $263,000, at 12% returns it grows to $614,000 and at 15% returns it is a cool $5.5 million.

Let that sink in for a minute…and remember, it doesn’t include reinvesting of dividends or active management of the money!!!

But I Don’t Have 40 years

I can hear you already, but I don’t have 40 years to build a comfortable financial future…

Well let’s look at what can be done in the shorter time frames.

Using the 15% return rate, in 30 years your $40 per week could have grown to just shy of $2.1 million…

And in 20 years it could have grown to $1.1 million.

Now that is a reasonably good financial future, right?

Now that is a reasonably good financial future, right?

The key to these numbers is not necessarily the amounts, but rather the clear demonstration of the power of time.

No matter how long you have, the key is to get started…

The longer you procrastinate, the more you sacrifice your financial future.

Considerations

Now that you know what YOU can do with as little as $40 per week, let’s have a look at some important considerations that can help you along the way…

Firstly, it is crucial that you tackle your debt.

The fastest way to speed up your financial future contributions is to eliminate debt. This way you can allocate the money that is currently lost to interest on debt to your financial future contributions.

Think about how much debt interest you are paying now and how that could change the numbers in the table above, exciting isn’t it?

The second consideration is where you should invest.

The scope of investments is too broad for this post, but as I suggested above, look for investments that have a history of above average returns over a long period of time. As your money grows you can start to spread your money across different types of investments, such as growth, growth and income, high growth and even some international exposure.

The key when starting out is to lock in a strong growth return in a product with a long history.

And the final consideration, that is the most crucial piece of the puzzle, is that you must stick with it.

The returns in the table above assume you are consistently adding $40 per week to your investment…

There are no holiday periods where you take a break.

You need to keep building for your financial future.

The markets will have good and not so good times, but history has shown us that it is consistently growing.

So just keep on adding more and more to your ‘comfortable financial future generator’. The rewards are worth the effort.

If this post has excited you to the possibilities of what you can achieve, and you want to know more, or would like someone to coach you through your financial affairs, click the link below to let me know, we can have a quick chat to see what is best for you.

Claim Your FREE Financial Strategy Coaching session

In this session we create a crystal clear vision for ultimate success, uncover hidden challenges that may be standing in your way, and you leave the session feeling renewed, re-energized and inspired to get results faster and easier than you thought possible!

Click here to claim your FREE Coaching Session