Yes there is one stock selection criteria for success that you can use to eliminate the noise when it comes to where to invest your money in the stock market.

Before I give you the stock selection criteria that I believe is the single biggest success factor that changed my results, let’s understand the reason why this is so powerful.

It’s actually counterintuitive, so that makes it harder for some to grasp, but more successful for those that do…

You see, human nature is that we look for short cuts. When it comes to money, people are strangely attracted to the get rich quick schemes that we all know are just that, schemes…

You see, human nature is that we look for short cuts. When it comes to money, people are strangely attracted to the get rich quick schemes that we all know are just that, schemes…

So when it comes to stock selection, the natural instinct for most is to be attracted to the noise when something is ‘cheap’ or a ‘bargain deal’.

The Number One Stock Selection Criteria

The simple criteria that you should use as your first stock selection criteria before investing any money in a stock, is:

Only Buy stocks that are increasing in price!

Seems so obvious doesn’t it? Yet, I can guarantee you, this stock selection criteria is ignored by so many new and advanced stock investors…

And the reason is that as humans, we have been trained to seek out the bargain, to buy cheap. So we are constantly attracted to stories of stocks that are falling in price and therefore becoming better ‘value’ or ‘cheap’ or worse ‘a bargain’.

The stock market is not like your local department store where they use discounts and fancy marketing strategies to convince you to buy. These types of purchases can make us feel good, especially when you get that new season pair of shoes for 25% off retail…

But when it comes to stock selection, hunting for cheap or bargains is fraught with danger.

To illustrate the point, let’s have a look at a couple of high profile examples.

The Enron Case

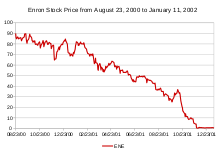

In the late nineties Enron was a market darling. Enron was an energy trader and supplier, and had grown to be one of America’s largest companies.

At its peak, the Enron stock price was over $90. When it declared bankruptcy in December 2001, its stock price was $0.26.

The interesting part about this story apart from the fraud that resulted in the company declaring bankruptcy, is the number of times that stockbrokers were recommending the stock as a BUY all the way down to $0.26.

The interesting part about this story apart from the fraud that resulted in the company declaring bankruptcy, is the number of times that stockbrokers were recommending the stock as a BUY all the way down to $0.26.

Following the theory that if the Enron price was once $90 and now it is less than that, it must be cheap, a bargain, or great value.

So, despite the company actually falling down around them, stockbrokers kept recommending that you buy the stock. The sad part is, people did, all the way down. As it got cheaper, people kept buying. They were acting as if they were at the department store and they were getting a great deal.

The only problem was, this was not a department store sale, this was a company that was collapsing.

If you had applied the stock selection criteria that I recommend, being only BUY stocks that are increasing in value, Enron, the market darling of the time, would not have been on your radar once it started to fall from $90.

A Personal Story

Closer to my home here in Australia there was a similar example with a company called Babcock and Brown (B&B).

Like Enron, it was a market darling for a period of time, valued in the billions, it seemed everything B&B touched turned to gold.

Its stock price had a similar trajectory, rising from below $10 to over $35 over a short period of years.

B&B was a stock that I purchased in September 2005 when it was about $17. As you can see from the stock chart below, it had already risen steadily when it was $17. It met the stock selection criteria.

B&B was a stock that I purchased in September 2005 when it was about $17. As you can see from the stock chart below, it had already risen steadily when it was $17. It met the stock selection criteria.

Now the hard part about this stock selection criteria is that there are times when you could be buying the stock at an all-time high price. Like I did in September 2005.

This is a very difficult thing for some people to do. It’s like buying those new season shoes on the first day they are released at full retail price. Doesn’t give you the feeling that you got a bargain, does it?

But that is why stock selection and shopping are two very different things, with two very different criteria for happiness.

As you can see the stock price climbed nicely from $17 up to more than $35. However, like Enron, B&B ran into difficulties and unfortunately no longer exists.

Fortunately, for me the story has a happy ending, as I used my exit strategies and sold the stock for $33 and was able to use the profits to purchase a new car for my wife.

A Word of Caution

As I mentioned, often this stock selection criteria will result in purchasing the stock at an all-time high price.

This would have been the case if you bought Enron at $90 or B&B at $35 in the examples above. The key caution in these instances is to ensure you have a proper risk management and money management plan…

In simple terms, you need to know what your exit strategy will be in the event that the price doesn’t continue to rise.

Exit strategies are beyond the scope of this post, but for now, understand that once you have entered a stock using your stock selection criteria, the next most important criteria is your exit for when things don’t pan out as expected.

Conclusion

One final tip, understand that you can’t and won’t pick winners every single time. Losses are a part of being an investor. The secret of the wealthy is to keep your losses small and your profits large.

Knowing in advance that you have solid selection criteria, that are supplemented with an exit strategy that alerts you when to take action and get out, then you will be on your way to building a solid portfolio of stocks that grow in value and provide a passive income.

I hope that helps with your stock investing. Leave me a comment below and let me know what you think of this stock selection criteria.

Also you may want to add avoid times while the Fed is making a announcement. Check the financial disclosure statement for around two years back to avoid creative accounting. Check the news to see if any pertinent data like a new product launch, or possibly a recall is underway.

Those three things have impacted my investing the most lately.