I bet when most people picture themselves having financial success, it feels completely intoxicating for a moment.

It’s sexy to think about making millions of dollars, being your own boss, driving fancy cars, and making it big.

But then you think … wait, I’m just not that lucky. I didn’t go to the right school, didn’t have the right this or that. I can’t do that, blah blah blah!

You feel like success comes easy to some people, but not to you.

This is the limiting beliefs I wrote about here coming in to try to derail you.

Do you think successful people have achieved what they have with the greatest of ease and simple luck?

Success is Not a Game of Chance

Success is a series of calculated daily choices… There’s that word again!

These choices lead to specific outcomes because there is clarity on the desired outcome and the steps to get there.

These choices lead to specific outcomes because there is clarity on the desired outcome and the steps to get there.

Then, there is complete obsession over ideas. They are dreamt about and moulded out of nothing. Reviewed. Then torn apart. Then put back together. Over and over again.

Now some tough love is about to follow. I think it is appropriate…

I get just as annoyed by the get rich quick schemes as I do the complaining about not having what you want or what you think you deserve.

Overnight success is a myth, especially when it comes to your personal money situation.

Quit complaining about what hasn’t come to fruition if you’re only compelled enough to talk and not compelled enough to take action.

There are a few people out there who do buy the winning lottery ticket and are handed a fortune. They got lucky, granted, but there is a sting in the tail of that one.

First, your odds of winning a big prize in the lottery are somewhere around 1 in 175 million depending on which lottery you pay. That isn’t a very exciting opportunity, right?

Second, statistics show that more than 70% of substantial prize lottery winners are worse off five years after having won then they were before they won. Some even end up going bankrupt, ouch.

So why do so many people still pay (and lose) so much money to something like the lottery?

Playing the Lottery is Easy

Just because you can do something, whatever it is, doesn’t mean you should.

Easy is just what it sounds like…

Easy leads to doing something half way: a job not completed. An idea only partially explored. A business not developed. A leader not leading.

Easy is a killer of success. It is the method of mediocrity.

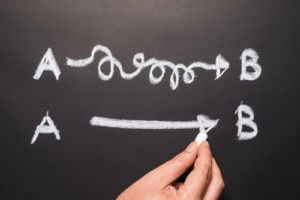

There is a big difference between easy and simple…Easy means not putting in the work.

Simple, on the other hand, indicates a clear path to the desired outcome. Simple isn’t easy. It’s understanding what is necessary to complete your goal.

Simple, on the other hand, indicates a clear path to the desired outcome. Simple isn’t easy. It’s understanding what is necessary to complete your goal.

This explains to an extent why such a large percentage of lottery winners end up worse off.

These people got lucky. They didn’t earn it. And then they didn’t know what to do with it.

Apparently, lottery winners don’t understand what to do with the money. They don’t have a knowledgeable team to advise their spending or investing.

Friends, relatives, and others who know they’ve won all come out of the wood work for a hand out, a loan, a new car, a house.

There are success stories however…I read about someone who was successful in keeping his lottery fortune.

Upon winning, this person immediately hired an accountant, an attorney, and a life coach. Why?

Because he knew he didn’t know what to do with the money. He knew he needed to bring in others who had experience, had been there before, and could help coach and guide him.

Financial Success is Simple—But Not Easy

Let’s take the example of flipping a house.

Flipping a house is simple. You need to buy it correctly at the right price. Then you must have the funds or the loan to purchase it.

It’s imperative that understand the contract for the purchase. You must know what the financing terms are and what they mean. Know your exit strategy and the value of the home before you buy it.

Otherwise, you won’t know what “success” is supposed to look like.

Then, you must hire the right contractor or have the required skills to do the plumbing, electrical, painting, and flooring. Install the right heating, ventilation, or air conditioning, and put a roof on the house.

Next, you need to get the windows in square. Pick the right colours for the exterior trim, the body colour, and the accent colour for the front door. Select the right tile for the bathroom, laundry, and kitchen.

Then, you must get the house put back together. Clean it. Market it correctly, and price it right. Get an offer. Understand what the contract says, and what the buyer is asking for. What are the obligations of each party according to the contract? Then it’s time to go through the escrow process, inspections, appraisals, and the negotiations throughout.

It’s simple. But it isn’t easy.

It’s Time for Accountability

If you aren’t doing what you want to be doing, then start doing it. It’s simple. Yes, I keep repeating myself for emphasis.

Do your homework. Make mistakes. Believe in the vision. Do the work. Make more mistakes.

You can’t be afraid to fail. Failing is a part of the learning process. It’s ok.

I have recently been with my mentoring group in the USA, and one of the key lessons that kept coming up was the need to get comfortable with failure.

Failure is the only thing that helps us grow and learn.

Your goals must be written down…

And they have to make sense. You have to believe in them and want them so badly that you are willing to accept nothing less than success.

This means that you are accountable to do whatever it is today in order to achieve the outcome you desire.

This means that you are accountable to do whatever it is today in order to achieve the outcome you desire.

You can’t achieve that outcome without having a crystal-clear vision of where you are going. You must be able to imagine what it will look like when you are done.

In fact, you should right now pause, close your eyes and imagine your life as it would be when you have the financial success you desire.

What will be different, what will you be doing, where will you be living, who will you spend your time with? See these things now as though they have already happened…

The Path to Financial Success is Not New

Whether your goals have been accomplished by others before (flipping a house, accumulating stocks, or building a business) or they are goals that have yet to be accomplished (curing cancer), there are examples, paths, and processes to achieving these outcomes.

Leonardo Da Vinci, Dale Carnegie, the Wright Brothers, Richard Branson, Oprah Winfrey, Mark Zuckerburg, Bill Gates, Warren Buffett, J. K. Rowling, Arianna Huffington, Meg Whitman; every single one of these people has enjoyed inspiring financial success.

They have taken risks…

They have suffered defeats. And they have learned from them, grown from them, and turned them into their own successes.

To be financially successful you must surround yourself with people who have similar motivations and goals.

Collaborate with leaders and believers. If none of the people you surround yourself with are doing what you want to be doing, then you are hanging out with the wrong people.

Conclusion

If you truly want to be successful, make today the end of easy.

Easy is dead. Simple is now.

Easy is dead. Simple is now.

Lay out your plan. Work, mould, build, learn, and grow.

Be the best at it. Believe in it. Be fanatical. Be crazy.

Who cares what anyone else thinks? Who cares what anyone else says? It doesn’t matter what they say.

One of my favourite quotes is by Eleanor Roosevolt, my family are sick of hearing me repeat it, but it is truly liberating when you get it: “You wouldn’t worry so much about what others think of you if you realized how seldom they do.”

Everyone is too busy worrying about themselves to care about you, your failures, or your so-called crazy financial goals…

If you really want to be successful at something, then make a plan and go get it.

And if you need help, I am here to assist you. Right now you can get 14 days of free coaching to identify your hidden surplus and create a plan to secure your financial future. Claim your call by clicking the link below.

Claim Your FREE Financial Strategy Coaching session

In this session we create a crystal clear vision for ultimate success, uncover hidden challenges that may be standing in your way, and you leave the session feeling renewed, re-energized and inspired to get results faster and easier than you thought possible!

Click here to claim your FREE Coaching Session