The two overriding human emotions are pleasure and pain. As simple as it sounds, we are constantly in search of pleasure and acutely aware of pain.

Since the festive season, I have been asked many times about the state of the stock and property markets. The more times the question came up, the more it was obvious to me that the question was coming from the emotions of pleasure and pain.

There is the obvious desire for pleasure from investing successfully… and then there is the fear of the pain in the event that your investing is not so successful.

How do you as an investor manage this emotional roller coaster?

What Time is It?

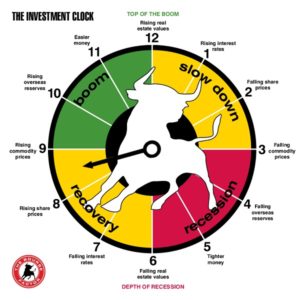

You may have heard about the economic clock.

It is a depiction of the economy that many market commentators will use to explain certain events that occur in financial markets…

It is a depiction of the economy that many market commentators will use to explain certain events that occur in financial markets…

So you might ask, what time is it?

This is where it gets interesting if you are a believer in the clock.

Now I should explain that generally I believe the clock to be a handy tool, and it makes for good discussion. But I don’t favour it as an investment decision tool, more on that shortly.

Coming back to what time is it now, you might note that there are a few things happening right now across the globe, such as:

– US stock markets continuing to make all-time highs

– Commodity prices, such as Gold and Oil are rising

– Interest rates are low, but rising

– Property prices are rising

When you consider these events and refer to the clock diagram, it would suggest we are anywhere between 8 and 1 o’clock.

These are unusual times where markets are being supported by a lot of government stimulus resulting in unusual markets.

That broad a range makes it difficult to use the clock as a decision tool don’t you think?

Pleasure and Pain

I mentioned the many times that the state of the markets came up in discussions recently…

The main question I have been getting is whether it is too late to invest in the stock market or property market.

The main question I have been getting is whether it is too late to invest in the stock market or property market.

The past couple of weeks of dramatic falls in bitcoin and a number of other cryptocurrencies may have been a contributor to these questions.

You will note that I suggested that Bitcoin was not for the faint hearted and definitely not for investors who were just starting out on their financial freedom journey. The past couple of weeks is exactly why I made those comments.

Anyway, I digress…

So there is an element of fear in the questions I have been getting about the markets. It seems you are concerned about getting into the market at the wrong time.

My favourite investor, the Oracle of Omaha, Warren Buffett, regularly proclaims that it is not about timing the market, but time in the market.

Another important lesson about investing that I have learned over the years is that you need to detach yourself from the emotions of the markets. Easy to say but very difficult to do when it comes to your hard-earned money. Especially when you are attempting to build a financially free future.

We want the pleasure of seeing our money grow, and at the same time, we want to avoid the pain of investing just before the market starts to turn down…

It’s a fine line between pleasure and pain, right!

How to Solve the Pleasure and Pain Problem

To solve the problem of the emotions of pleasure and pain when it comes to successful investing is actually quite simple.

In fact it is so simple you might even dismiss it as too simple.

The solution, is to set up a regular investing schedule and stick to it no matter what is happening in the markets.

If you have followed my 5 Steps to Financial Freedom, which you can get here, you will know it is as simple as identifying the amount of money you have available each period, whether it is a week or month, and consistently applying it to your investing strategy.

If you have followed my 5 Steps to Financial Freedom, which you can get here, you will know it is as simple as identifying the amount of money you have available each period, whether it is a week or month, and consistently applying it to your investing strategy.

By having a schedule and a known amount of money each period, you completely detach yourself from the pleasure and pain battle, and just keep adding to your investments.

Markets will go up, come down, and go back up again.

Your success is measured not by whether you timed your entry in the markets perfectly, because nobody can do that on a consistent basis, but instead, by the time you are in the markets.

Investing for your financial future is a long-term game. Whatever is happening in the financial markets is generally short term.

You aren’t reading this blog post because you are looking for a get rich quick scheme, we don’t believe in them, right?

We are in this for the long haul and therefore we know that markets are going to go up and down. We use this to our advantage by investing across a range of markets, instruments and time so that over the long term our results will be incredible.

So forget about the pleasure and pain battle and just keep on investing, it’s the only thing that has worked in the history of the financial markets.

Leave me a comment below and let me know how you are going to use this information to improve your investing results.